The yield on the 10-year US Treasury hit 1% for the first time since March, after the yields from The Georgian runoff election closely watched He raised bets that the Democrats could win tight control of the Senate.

By mid-afternoon in Hong Kong on Wednesday, the yield on the 10-year US Treasury was 1.019%, according to Tradeweb, up from 0.955% at the 3 PM ET close on Tuesday.

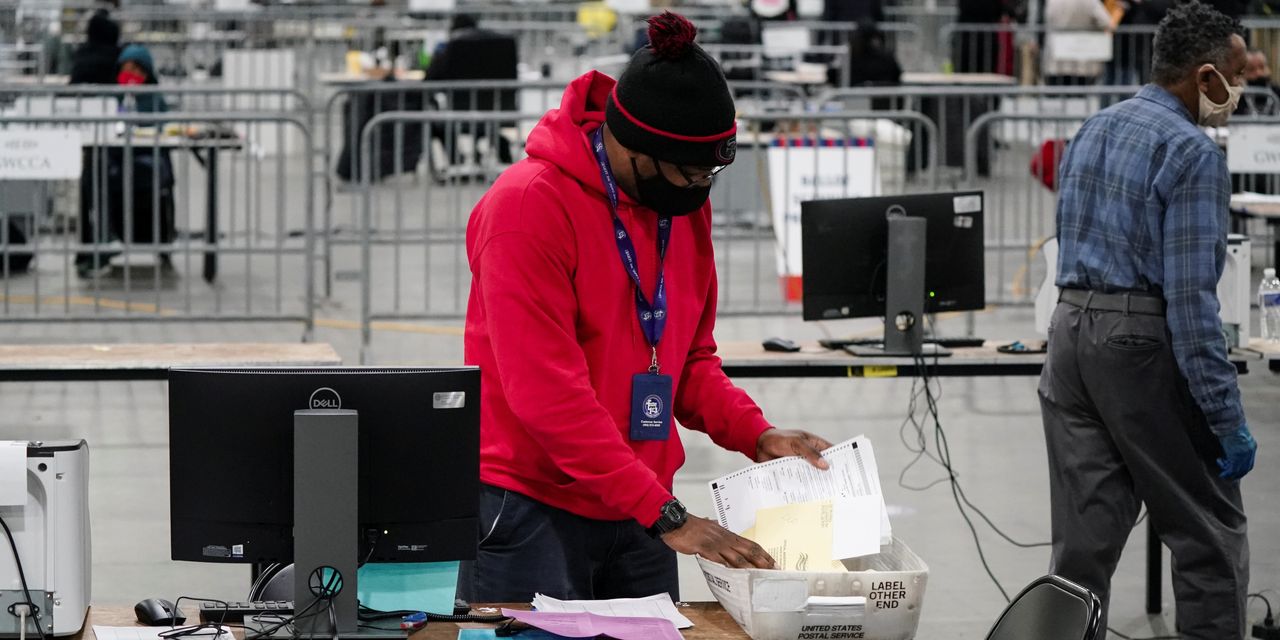

Democrat Raphael Warnock defeated current Kelly Loeffler in one of the Georgia rematches, according to the Associated Press, while the second race remained very close to the competition.

Yields, which rise when bond prices fall, began to rise on Tuesday night as early returns from the election began pouring in, showing very tight races but better than expected results for the Democratic candidates.

Wins in both races would effectively give the Democrats 51 votes in the Senate, when counting the cutoff votes for the vice president-elect.

An outcome that many investors believe will herald greater spending on relief efforts from the pandemic and other democratic priorities such as infrastructure projects.

An increase in government spending without the corresponding tax increases tends to increase Treasury yields in part because it heralds more government borrowing and an increased supply of bonds. Depending on the type of spending, it can also increase returns by boosting economic growth and inflation and increasing the likelihood that the Federal Reserve will raise short-term interest rates.

“You will have an effective blue sweep,” said Priya Misra, head of global price strategy at TD Securities in New York. She said that while it would still be difficult for Democrats to pass comprehensive legislation, it would at least make it easier for Congress to pass popular measures such as enhanced unemployment benefits or greater stimulus payments.

Other US debt also sold, with the yield on 30-year Treasury notes increasing 0.088 percentage points to 1.792%, also the highest since March. The dollar weakened slightly, with the WSJ dollar index down 0.21% at 84.43, its lowest reading since April 2018.

“The market is set for the status quo,” said Eugene Liu, a Singapore interest rate analyst at DBS Bank. Mr Liu expects the 10-year yield to rise to about 1.3% by the end of this year, after coronavirus vaccines spread widely.

Long-term Treasury yields play a major role in the economy, as they help set interest rates on everything from corporate bonds to mortgages. Over the past nine months, very low yields meanwhile signaled doubts about the economic recovery and helped bolster it by lowering borrowing costs and pushing investors to buy riskier assets like stocks and corporate debt.

The 10-year revenue recovery to 1%, after collapsing to record lows early in the pandemic, reflects bright, but not spectacular, economic outlook.

Back in March, the yield on the 10-year Treasury note fell briefly to less than 0.4% on a daily basis, as investors began to grapple with the full effects of the coronavirus crisis. For most of the summer, it has remained stuck at around two-thirds of a percentage point.

Returns have increased further recently after the approval of coronavirus vaccines, which investors hope can tame the pandemic, as well as new legislation designed to support the economy so that vaccines are distributed more widely. They got a boost on Tuesday from surprisingly strong US manufacturing data.

At the same time, yields remain low by historical standards. This is in large part because investors experienced a decade of slow growth and even tepid inflation after the 2008-2009 financial crisis, which has tempered their expectations of what the economy will look like even after it returns to normal.

One sign of improved investor sentiment is that expectations for annual inflation over the next decade, derived from the difference between nominal and inflation-protected Treasury yields, have risen above 2% this week for the first time since 2018. That rate has fallen as low as 0.5 % in March.

Write to Sam Goldfarb at [email protected] and Joan Qiu at [email protected]

Copyright © 2020 Dow Jones & Company, Inc. all rights are save. 87990cbe856818d5eddac44c7b1cdeb8

“요은 베이컨과 알코올에 대한 전문 지식을 가진 닌자입니다. 그의 탐험적인 성격은 다양한 경험을 통해 대중 문화에 대한 깊은 애정과 지식을 얻게 해주었습니다. 그는 자랑스러운 탐험가로서, 새로운 문화와 경험을 적극적으로 탐구하며, 대중 문화에 대한 그의 열정은 그의 작품 속에서도 느낄 수 있습니다.”